Teach her financial responsibility, but know when to draw the line. After all, she is still a kid…

Rising utility and automobile gasoline prices, college tuitions and emergency trips to the veterinarian are just a sampling of issues that put a strain on a family’s budget. Coupled with peer pressure to have the latest fashions, the rising costs of after school and extra-curricular activities, contacts and braces, many families find themselves needing to periodically revise their budgets.

Rising utility and automobile gasoline prices, college tuitions and emergency trips to the veterinarian are just a sampling of issues that put a strain on a family’s budget. Coupled with peer pressure to have the latest fashions, the rising costs of after school and extra-curricular activities, contacts and braces, many families find themselves needing to periodically revise their budgets.

Our children overhear financial discussions and casual statements everyday. They see prices on nearly every item in stores and malls and are aware that their parents work. Despite being aware that money is a part of life, many parents question how much financial information they should share with their children.

Whether your family is pinching pennies or fiscally sound, do you know if your child understands the concepts of saving and spending money? How much does your child know – or want to know – about your family’s financial footing? Knowing when, where and how to approach financial topics with your children will alleviate your child’s confusion, prevent misconceptions and ensure your family is all on the same financial page.

1. Be age appropriate.

Remember that $100 to a 5-year-old is like $100,000 to an adult. If you’re experiencing a budget crunch or trying to teach your child fiscal responsibility, offer an explanation that won’t cause confusion or stress for your child. Nancy Woodbury, M.A., M.F.T., urges parents to avoid lengthy and confusing lectures. “Substitute dollar values for items when talking to young children,” she recommends. Explaining that it takes the equivalent of three Deluxe Barbie Dolls to purchase one tank of gas helps a child relate to your family’s expenditures. Older kids understand the value that five new CDs can equal one month’s telephone bill.

2. Keep it simple.

Providing a realistic and honest answer to “Can we go to the movies?” helps young children begin to understand basic concepts of budgets, limits and saving. Answering with “Not today, but we can go when I get paid” honestly answers her question without creating the feeling that she’s asked a bad question.

3. Choose the proper forum.

Discussing your family’s finances in the grocery store or when a friend is over creates an uncomfortable and awkward situation for everyone. “I’m not comfortable talking about this in the store. Let’s wait until we’re in the car (or at home, etc.)” rebuffs your child’s insistence to purchase items not on the list, without making her ideas or input seem insignificant. Avoid discussing money and finances when you’re feeling stressed or taxed to reduce the chance of everyone becoming overwhelmed.

4. Teach consequences.

Establishing an allowance or chore reward system offers a clear plan for children to follow and develop an accurate perspective of money. A chart posted on the fridge or in a high traffic area lets kids know their job description, as well as monitor their performance review. A child can see that performing tasks efficiently and to the best of her ability can earn a bonus. Remember allowances do not have to incorporate a monetary payment.

You can offer a video or movie rental, one chore free day for every two weeks of work, the chance to plan the family’s weekend menu or a variety of other creative options. Creating an account for your child to drop slips of paper or tickets into for each successfully completed task helps her understand saving. When she’s ready to purchase, either a chore free day, his monetary allowance or a video rental, he’ll understand the consequence and correlation of earning, saving and spending.

5. Preserve a clear perspective of money.

“It is important that children grow up with the understanding that money and material items do not necessarily equate to happiness, social status or worthiness as a person,” believes Vaughan Langille, an investment advisor. “Children should know that money provides the option to purchase items and objects without becoming fixated on thinking that it represents who they are inside.” Langille advises his clients to devalue the significance of money to balance a child’s ideals. “Teaching them that riches include health and family helps to maintain a clear perspective,” he explains.

6. Paying for the roof over their head.

Let children know what it takes to run a household without imposing guilt or pressure. As a parent, you work to provide food, utilities, etc., not just a trip to the amusement park. Explain that the electricity to power the computer or cordless phone is not a free and unlimited resource. Factual and simple information for younger children helps develop the association that we’re all buying utilities as we use them. Older children benefit from knowing homes have mortgages, taxes and insurance costs.

“Paying for a new roof, furnace or faucet is something a preteen or teen can and should comprehend,” explains Patty Wexler, mother of four teenagers. Wanting her children to understand the reality of living in a home, either rented or owned, Wexler’s teens take turns once a month helping her sort through the household bills and balance the checkbook. “I don’t want my children to be surprised when they’re out in the world and have to pay their own way,” she adds.

7. Establish financial responsibility.

Cheryl DiCanni is a certified senior advisor and a registered investment advisor whose clients prepare for their future, plan for college and take vacations. She recommends talking with young people to teach them how to portion their allowance, monetary gifts, and babysitting or lawn mowing earnings into three separate funds to help instill solid financial responsibility. “Guiding a child to disperse his money between a long term savings account (for college, etc.), a short term goal account (for new CDs, video games, etc.) and a slush fund (for going to the movies with friends or a new pack of baseball cards) offers valuable lessons,” states DiCanni.

8. “How much do you make?”

A child’s healthy curiosity coupled with images and stereotypes offered all around him usually leads to him asking this loaded question. Base your answer on your child’s age, understanding and respect of your family’s level of privacy, and the ability to fully comprehend a dollar figure. If you’re uncomfortable divulging an exact figure, “We earn money to support our family,” provides a reassuring answer without assigning a dollar amount. Understand that most children younger than 10 believe their parents are rich and are very proud of the work you do regardless of your paycheck. Easing her fears of not having enough money, or curiosity about your family’s financial situation can often be accomplished with honest and simple information.

9. Know the common misconceptions.

Having checks or debit/credit cards automatically equals having money to purchase anything is the most common belief of children and early teens. According to investment banker Bruce Steffens, “Parents should explain that purchases made on a credit card have to be paid for.” Allow an older child to review the credit card statement with you to see the purchase of his new sneakers you made two weeks prior reflected on the bill. Many children also believe that blank checks equal unlimited money. Once again Steffens recommends a simple explanation. “Contact a local financial institution to schedule a tour for your child accompanied by a brief overview of bank accounts.” He further notes that, “Understanding that checks do not equate to money can spare children a great deal of confusion.”

10. Don’t let children feel responsible for loss or shortage of funds. There is a difference in teaching the economic efficiency of shutting off lights as opposed to overstating how expensive it is to raise or clothe children. “Kids can develop anxiety and increased levels of stress from financial troubles,” cautions Child Advocate Specialist Dianna Derby. Working with low- to middle-income families, she understands how adversely financial matters can affect a child’s self-esteem and confidence, especially if the child begins to feel she is a burden on the family’s wallet.

“I’ve seen children run away just to save their parents from having to pay for new clothes or school lunches.” While their caring and concern for their family is commendable, many children grow to feel overly responsible for their family’s financial matters. That’s why it’s important to teach them about money matters, but do it wisely. 🙂

Gina Roberts-Grey is a licensed clinical social worker and freelance writer.

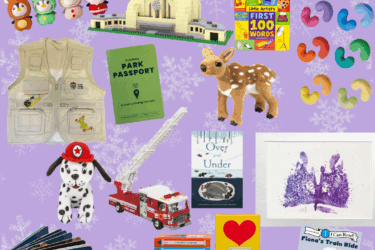

GET READING!

Looking for some helpful reads? Try one of these kid-friendly money books.

The Kids’ Money Book: Earning, Saving, Spending, Investing, Donating (Sterling)

By Jamie Kyle McGillian

Neale S. Godfreys Ultimate Kids Money Book (Simon and Schuster Children’s)

By Neale S. Godfrey, Illustrated by Randy Verougstraete

The Everything Kids’ Money Book (Adams)

By Diane Mayr