American families have experienced an average 25 percent decline in their net worth, and the economy’s in the tank. What can you teach your kids about it?

You know the saying, “Little pitchers have big ears?” Well, it’s true. Kids may not listen when you ask them to pick up their socks, but they’ve got supersonic hearing when you naively think you’re having a private conversation in another room.

You know the saying, “Little pitchers have big ears?” Well, it’s true. Kids may not listen when you ask them to pick up their socks, but they’ve got supersonic hearing when you naively think you’re having a private conversation in another room.

And if your kids are as nosy and clever as mine, they’ve heard you utter the word “recession” or heard about it at school or on television. But how much do they really understand, and how much should you explain to them?

If you think discussing money with children is awkward, consider this: The fastest growing group of bankruptcy filers are age 25 or younger (Senate Committee on Banking, Housing and Urban Affairs, 2002), and half of all college students carry four or more credit cards with an average balance of $3,000 (U.S. Department of Education). Maybe it’s time to move out of our parental comfort zones and start taking charge of our children’s financial education to ensure they don’t end up crippled by debt before they land their first real job.

Life Lessons

My kindergartener knows that a mortgage is money we pay each month for our house, and Mom and Dad work to earn money to buy food, clothes and entertainment. She knows that if work is slow or unforeseen expenses, like that recent gutter repair, arise unexpectedly, we might not go out to eat on a given Friday night … or the next Friday, either. She sees both Mom and Dad add up their weekly receipts at the kitchen table to determine how much they have left to spend until next month. When she or her 8-year-old sister ask why our SUV doesn’t have iPod docks or a drop-down DVD player, my standard answer is, “Because I’ve never had a car payment and never will.

Now look out the window and count the cows.” My kids don’t worry about money because we’ve never given them reason to, but from simply living with adults who avoid debt and stick to a budget, they already understand the rudimentary basics of earning, saving and budgeting. On the other hand, another 5-year-old recently told me that her daddy goes to work to sell air conditioners and that money comes from the ATM machine. She said a receipt was the piece of paper Mommy got from the Kroger lady and threw away on the way to the car!

Because each family and each child is unique, nationally syndicated radio talk show host and personal finance expert Dave Ramsey says that financial discussions with your children should be “age appropriate and child appropriate” but that no matter what, he says, “You need to begin by age 5.” He says, “Teaching children to handle money is part of quality parenting.”

How to begin? Ramsey says, “The first lesson is to teach children where money comes from … work!” He recommends parents start paying children when they start working around the house. Ramsey says, “It doesn’t have to be a lot, but you want them to associate money with work.”

Next kids should learn to save a portion of their money, give some of it to charity and spend some on fun stuff like toys. “If at 4, 5, 6 or 7 they’re accustomed to working for money and putting it in ‘give,’ ‘save’ and –spend’ envelopes, you’ve got a real solid knowledge base to discuss these bigger issues later,” Ramsey explains. If they work to earn money, they’ll more easily understand that a family member’s job loss or pay cut translates to less spending money for everyone. “If you haven’t done this early,” Ramsey cautions, “they won’t have that point of reference later as a 13-year-old.”

And what about those teens who still think money comes from the bank machine and their weekly allowance is a given right? It’s never too late to jump start a child’s financial education, even if they’ve been the pampered recipients of Mom and Dad’s generosity for all these years. Ramsey says, “It’s really good for a 14-year-old with –mall-i-tis’ to sit down with Mom to go over the budget so they realize there is an electric bill that takes priority over new tennis shoes.” And chores? You bet. Young teens are capable of cooking dinner, mowing lawns, raking leaves, cleaning house, dog walking and babysitting to earn spending money and should be taught to save and give a portion of their earnings.

In a few short years, they’ll have to do it all on their own with much larger numbers and real consequences, so give them as much experience and practice as you can while they’re young.

Information Overload

When it comes to discussing money with children, there is such a thing as too much information. As Ramsey says, “You don’t sit down and turn on CNN for an 8-year-old; it’s too much.” Likewise, if your family is directly affected by the recession, he advises, “You don’t want to go into a huge bunch of drama about car repossessions and foreclosures, but if Dad lost his job and you can’t go to Disney, you should explain that.”

Certified marriage and family therapist Jim Anderson, Ph.D., director of Harpeth Hills Counseling Center, says that there are times when it’s a good idea to discuss expenses with your more mature kids. “The financial discussions in front of children are the ones where they can give direct input,” he says. So if your family has enough expendable income to give a child a big birthday party or a week of summer camp, it’s absolutely appropriate to discuss the pros and cons of each and let the child decide how the money is spent on his behalf.

And if your family is affected by the recession and needs to cut back on expenses, you can tell the kids that you’re giving up your gym membership for six months and ask them if they can think of ways to cut back, too, such as giving up cell phones or cable television for a while. Anderson says, “I think it’s important for kids to be part of the awareness as well as part of the solution.”

Attitude Is Everything

No matter how you explain family finances to your children, always keep in mind that your goal is to give them an education, not a guilt trip. As frustrating as it may be to listen to your son beg for another video game or your daughter declare “It’s not fair!” that she can’t go to the hottest concert of the year, use restraint and avoid saying things like, “We just paid $2,000 for those braces, so don’t ask me for another thing.”

Even innocent jokes like, “If you keep growing at this rate, we’re going to go broke buying new shoes for you” can make children feel guilty and anxious about expenses that are beyond their control. Anderson warns, “Parents can overdo it by creating panic and shame.”

He tells parents to keep it simple, but honest. “Kids will be accepting of the situation if parents don’t overreact themselves,” he says. For younger children, Anderson recommends saying something like, “Because work is slow at Daddy’s job, we have a little less money this year, so instead of going to the beach this summer, we’re going to have fun in town at the wave pool, and we’ll try to go to the beach next year.”

If your older children are mature enough for more details, Anderson says bring them into the loop, because they’re astute enough to pick up the tension in the house and realize something’s going on anyway. When you hide the important issues from older children, “you’re saying we don’t think you’re capable of handling this and have to hide it from you,” Anderson says. “It honors the child when parents say, ‘I want to give you a heads up about this.'”

The key is to keep your attitude honest and encouraging so your kids will, too. Anderson says, “We all need a sense of hopefulness about adversity. If we model that for our children, we can trust they’ll follow our example.”

Deborah Bohn is a frequent contributor to this publication. She is a mom and fitness expert.

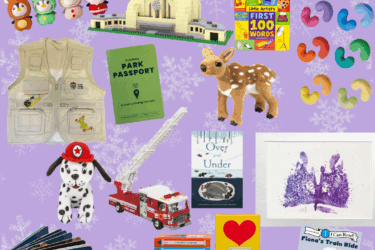

Tools to Help Them Learn …

With unemployment at a 20-year high and the nation deep in recession, what children can learn about money today will impact their well-being in the years to come. Give your children the gift of a debt-free life by teaching them to manage their money from a young age with Dave Ramsey’s Financial Peace Jr. (Ages 3 – 12).

With unemployment at a 20-year high and the nation deep in recession, what children can learn about money today will impact their well-being in the years to come. Give your children the gift of a debt-free life by teaching them to manage their money from a young age with Dave Ramsey’s Financial Peace Jr. (Ages 3 – 12).

The kit contains a chart to track money earned for chores, “save,” “spend” and “give” envelopes and a board to post a picture of what your child is saving up to buy. There’s an audio CD and easy-to-follow instruction manual, along with a calculator, fridge magnets and a coin case.

It’s easy, it’s fun and for just $10, this kit makes good financial sense. Available at www.daveramsey.com.